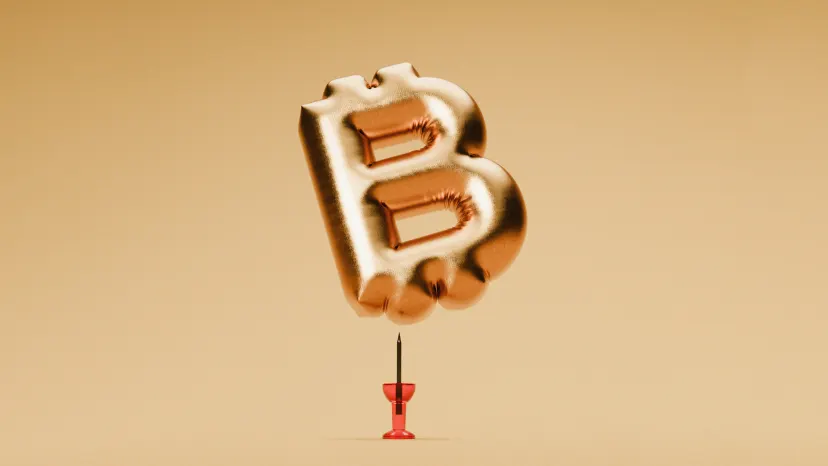

Should Your Business Be Investing in Bitcoin?

Is it time for your company to consider allocating some of its savings into Bitcoin? You wouldn’t be alone if you did. An increasing number of businesses across a wide range of industries are purchasing the volatile cryptocurrency, seeking to hedge against inflation and attract investors, according to a recent report by The New York Times.

Bitcoin, the most recognized of the many cryptocurrency assets, has experienced a remarkable surge since its inception in 2009, skyrocketing by over 1,000 percent in value over the past five years alone. Just last month, Bitcoin hit an all-time high of $100,000 per coin, partly due to expectations that the incoming Trump administration would foster a more crypto-friendly environment. (Trump has previously expressed his desire to make the U.S. the “crypto capital of the world.”)

However, Bitcoin remains controversial. Unlike traditional currencies such as the U.S. dollar, it isn’t backed by any government, and its price can be extremely volatile. Critics argue that cryptocurrencies, including Bitcoin, should face stricter regulation. Former SEC chair Gary Gensler, for example, described Bitcoin as “primarily a speculative, volatile asset” that is widely used for illegal activities, such as ransomware attacks, money laundering, and terrorism financing.

This volatility means that investing in cryptocurrency carries significant risks—both for individual investors and companies.

“I cannot understand how a risk-averse board could justify an investment in digital assets, given the significant price swings,” said Naresh Agarwal, an associate director at the Association of Corporate Treasurers, in an interview with The Times.

Despite these risks, more and more companies are diving into the cryptocurrency market, with over 70 public companies reported to have invested in Bitcoin, according to estimates shared in the Times article.

Among these corporate investors are crypto-focused companies like Coinbase, the Bitcoin exchange, and LM Funding, a Bitcoin mining firm, as well as tech billionaire Elon Musk’s Tesla, which has long been a crypto advocate.

Interestingly, some companies unrelated to crypto are also investing in Bitcoin. For example, the CEO of the marketing firm Banzai told The Times that he believes, “It makes sense to own this thing.” Banzai plans to invest up to 10 percent of its corporate treasury in Bitcoin, partly as a strategy to guard against potential inflation in U.S. dollars.

Holding Bitcoin has also made some companies more appealing to investors seeking indirect exposure to digital currency. Software company MicroStrategy, which has gained attention for its bold Bitcoin investment strategy, saw a surge in investor interest as its Bitcoin reserves grew.

As corporate investment in Bitcoin grows, even everyday investors may find themselves indirectly exposed to Bitcoin’s fluctuations—simply by owning shares in conventional companies or index funds that are involved in the cryptocurrency space.