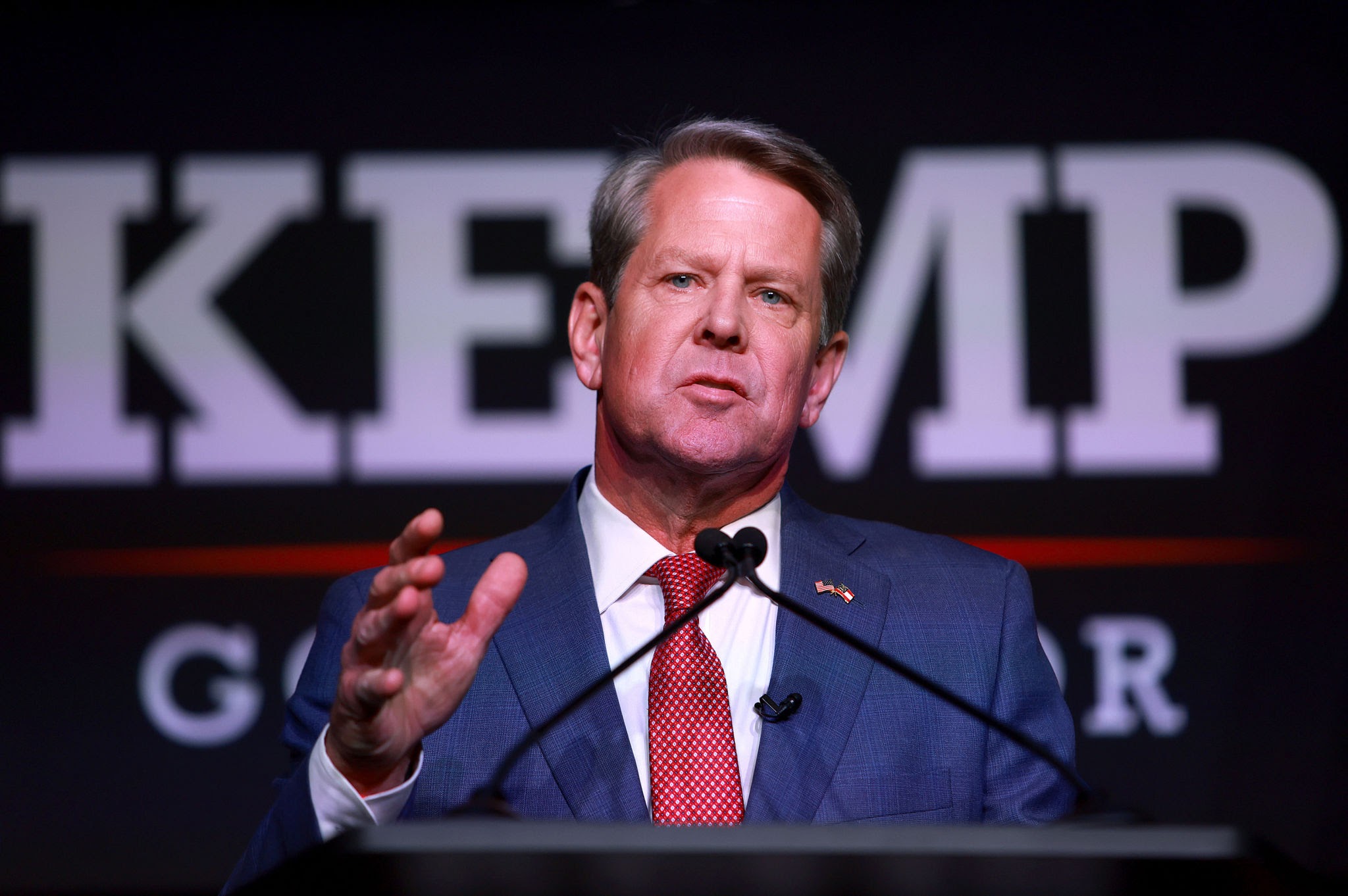

Georgia Gov. Brian Kemp and Republican lawmakers are intensifying their efforts to limit civil lawsuits, following years of stalled attempts. Their renewed push is gaining support from business groups, which have labeled Georgia a “judicial hellhole,” claiming that the state’s legal environment is driving up insurance premiums and placing financial strain on businesses through excessive litigation and large settlement payouts.

Senate Majority Leader Steve Gooch, a Republican from Dahlonega, stressed the broader impact on Georgians. “This issue isn’t just about businesses,” he said. “It’s about every Georgian paying more and more in insurance premiums. Whatever we can do to make it more affordable to own a home, operate your vehicle, and protect your family with insurance, we need to do it.”

However, critics argue that there is no solid evidence linking lawsuits directly to rising insurance rates. They claim that imposing limits would make it harder for injured parties to receive fair compensation in court.

“This is about doing favors for people who may line your political coffers,” said Jen Jordan, an attorney and former Democratic state senator. “At the end of the day, Georgians are going to be hurt.”

In 2022, Kemp promised the Georgia Chamber of Commerce, one of his key allies, that he would work to reduce lawsuit-related costs—a move many have labeled “tort reform.” Yet, in 2023, he acknowledged the complexity of the issue and instead signed a law to gather data on lawsuit verdicts to better understand the problem.

As the legislative session begins, Kemp faces a difficult political landscape: GOP lawmakers who make their living through litigation, Democrats who oppose the changes, and a state Supreme Court that has previously struck down lawsuit limits.

High-Profile Lawsuits Highlight the Debate

One primary point of contention involves lawsuits against property owners—including stores, apartment complexes, and businesses—over injuries or crimes that occur on their premises. One such case saw Georgia mother Sheila Brooks suing Family Dollar and Dollar Tree after her son, Lem Johnny Johnson IV, was fatally shot at one of their South Atlanta stores.

Although the shooter was not an employee, the lawsuit claims that Family Dollar was aware of previous violent incidents at the location and failed to implement adequate security measures. Supporters of limiting lawsuits argue that property owners should not be held responsible for the criminal acts of trespassers or customers.

“If we address this problem, Georgia could be seen as a more business-friendly state,” said attorney Bill Custer. “It will improve our reputation as a bad-boy state.”

Nancy Palmer, spokesperson for the Georgia Chamber of Commerce, said the state’s legal environment has driven insurers away, leaving businesses with limited insurance options. She argued that rising insurance costs have become “untenable” for businesses in various sectors, including daycare centers, grocery stores, pharmacies, and affordable housing providers in both urban and rural areas.

Impact on Affordable Housing and Rising Insurance Costs

Darion Dunn, managing partner at Atlantic Strategies and a developer of affordable housing, explained how rising insurance premiums are forcing businesses to walk away from projects that could address the state’s housing crisis. “Because of these rising insurance costs, we’ve had to abandon projects that would have provided much-needed affordable housing,” Dunn said.

Dunn advocates for lawmakers to impose caps on compensation for non-economic damages, such as emotional pain and suffering. In 2005, Georgia’s legislature implemented such caps, but the state Supreme Court ruled them unconstitutional in 2010.

The Georgia Trial Lawyers Association has pushed back against claims that insurance premiums are rising because of large jury verdicts. In a statement, the association argued that “insurance companies have continued to raise premiums despite making record profits.”

Proposed Measures to Limit Liability

To reduce property owners’ liability, lawmakers may consider limiting the types of evidence that can be used in lawsuits, particularly in cases where property owners knew about potential risks, such as violent crimes. They may also instruct juries to assign a minimum level of blame to the criminal responsible for an incident. For instance, in a 2023 case, a man won almost $43 million after being shot during an armed robbery in a CVS parking lot. The jury found CVS 95 percent responsible for the shooting, while assigning just 5 percent of the responsibility to the victim and no responsibility to the shooter.

While such large verdicts are rare, Atlanta attorney Madeline Summerville, a political consultant for Democrats, argued that they often occur when insurance companies refuse to settle cases they should. She warned against creating laws based on the actions of a minority of cases. “You can’t make legislation based on the fact that there’s a minority of people trying to game the system,” Summerville said.

She also expressed concern about potential changes to medical malpractice lawsuits, arguing that if medical professionals aren’t held accountable, the quality of care in Georgia will suffer.

Rising Insurance Costs and Medical Malpractice

In a roundtable last fall, medical executives told Kemp that rising insurance premiums are a major concern for healthcare providers. Van Loskoski, CEO of Stephens County Hospital in Toccoa, shared that the hospital was unable to recruit obstetricians due to fears of lawsuits, prompting the hospital to stop delivering babies in 2021. Following that decision, medical malpractice premiums dropped by 13 percent.

To address rising costs, lawmakers may consider laws similar to those passed in Florida in 2023, which require attorneys to disclose the actual medical costs paid by plaintiffs, rather than inflated charges. Legislators may also hold separate trials to determine fault for medical damages and assess the financial damages owed.