Nvidia just reminded the world who dominates the stock market.

On Monday, the chipmaker surpassed Apple to become the world’s most valuable company by market capitalization. Its stock closed at a record high just hours before CEO Jensen Huang delivered his keynote address at the Consumer Electronics Show (CES) in Las Vegas, where he introduced the new RTX Blackwell chips.

“The [AI] applications are truly endless,” Huang told the audience late Monday. “When you see application after application that are AI-driven, AI-native, at the core of it, this fundamental concept is there—machine learning has transformed how every application will be built.”

While Nvidia’s stock traded relatively flat throughout 2024, it surged in the first week of the new year, already up 10 percent. On Monday, shares jumped as much as 5 percent before settling at a record high of $149.43 per share.

In the past 12 months, Nvidia’s stock has skyrocketed by approximately 207 percent. It was one of the five most popular stocks of 2024, joining companies like Advanced Micro Devices, Microsoft, Amazon, and Palantir, according to Schwab’s Trading Activity Index.

Just a week ago, Microsoft unveiled plans to invest $80 billion in AI infrastructure this fiscal year, a sharp increase from the previous year’s $50 billion.

Other industry giants have made similar ambitious predictions for AI-related spending, leaving Nvidia shareholders thrilled.

“The industry is chasing and racing to scale artificial intelligence,” Huang remarked, adding that the new Blackwell chips are now in “full production,” while Nvidia-trained AI agents present a multitrillion-dollar opportunity.

Despite Nvidia’s overwhelmingly positive outlook, strategists at Bank of America note a few risks:

- Weakness in the consumer-driven gaming market

- Competition from both private and public AI and computing companies

- Larger-than-expected impacts from China shipping restrictions

- Unpredictable sales in enterprise and data centers

- Increased government scrutiny over Nvidia’s dominance in AI chips

Nevertheless, Huang and his investors remain unconcerned. At CES, the crowd of technologists buzzed with excitement about Nvidia’s next steps.

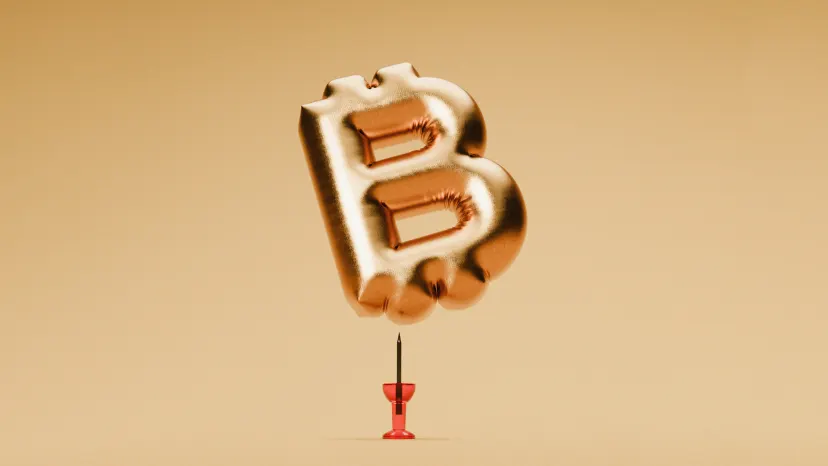

“Over the past few years, we’ve discussed the AI revolution nonstop, as it represents the biggest tech transformation in over 40 years,” said Wedbush strategist Dan Ives, ahead of Huang’s keynote. “This $2 trillion AI spending wave began with the Godfather of AI, Jensen, and Nvidia, as they are the only game in town with chips that have become the new gold and oil.”